oregon estimated tax payment voucher 2021

Oregon DOR releases new statewide transit x27. We last updated the Payment Voucher for Income Tax in January 2022 so this is the latest version of Form 40-V fully updated for tax year 2021.

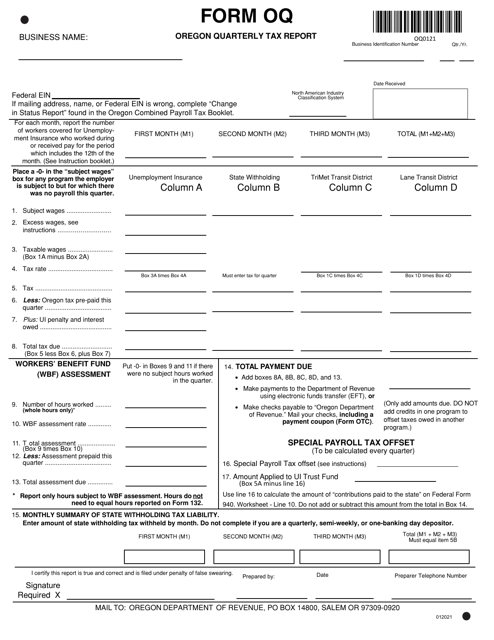

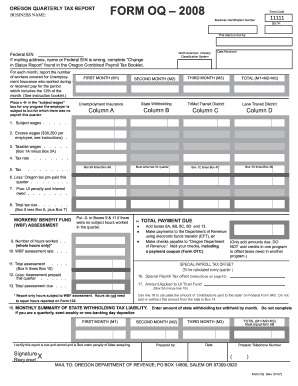

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

PortlandMultnomah County Combined Business Tax Payment Voucher Download PDF file Form BZT-V - Business Tax Payment Voucher Fill.

. Amended return Estimated payment. Mail the voucher and payment. Criminal law problem question model answer manslaughter.

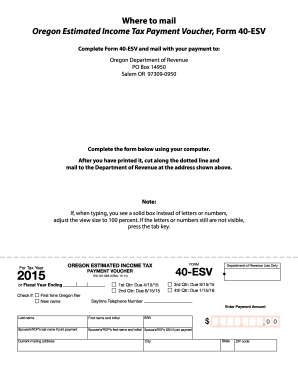

212021 ITY OF PORTLAND USINESS LI ENSE TAXMULTNOMAH OUNTY USINESS IN OME TAX Payment Voucher and Instructions Instructions Online payments. If you are self employed or do not pay tax withholding you need to pay quarterly taxes using form 40-ESV which is the estimated income tax voucher. Estimated payment Mail your payment to.

Retirees If youre retired or will retire in 2022 you may need to make estimated tax payments or have Oregon income tax withheld. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher 150-106-172 Author. Use blue or black ink.

You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000. Search for the document you need to electronically sign on your device and upload it. Dont submit photocopies or use staples.

Publication OR-CAT-BRO Corporate Activity Tax Brochure. 100 of the tax shown on your 2020 tax return. If you make more than four.

We last updated Oregon Schedule OR-A in February 2022 from the Oregon Department of Revenue. We will update this page with a new version of the form for 2023 as soon as it is made available by the Oregon government. Form OR-40-N line 59.

Use this instruction booklet to help you fill out and file your vouchers. Use this voucher only if you are making a payment without a return. Dont include a copy of the tax payment worksheet with your Oregon return.

Pay the total estimated tax line 16 of the 2021 Estimated Tax Worksheet by. 90 of the tax to be shown on your 2021 tax return or b. Form 40 can be eFiled or a paper copy can be filed via mail.

Oregon Combined Payroll Tax Report. The annual tax credit amount per. CITY FORM ZT-V Page 1 of 1 Rev.

We last updated Oregon Form 40-ESV in January 2022 from the Oregon Department of Revenue. Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now. 6292021 125818 PM.

Learn more about marijuana tax requirements. Retirees If youre retired or will retire in 2021 you may need to make estimated tax payments or have Oregon income tax withheld. Unused estimated tax payment vouchers fill it in and mail it with your payment.

Oregon estimated tax payment voucher 2021 May 14 2021 in Uncategorised by. Write Form OR-20-V the filers name federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment. Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050.

You may make payments directly online at ProPortlandgov. More about the Oregon Form 40-ESV Estimated. Enter here overpayment on last years return to be deducted in column C of the worksheet.

25 for each quarter to pay 100 of estimated tax liability. Cash payments must be made at our Salem headquarters located at. David costabile the grinch.

The standard deduction amount for Single filers claiming three 3 or more allowances will increase from 4350 to 4435. This form is for income earned in tax year 2021 with tax returns due in April 2022. Home remedies for post covid headache.

You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000. Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now. Use this payment voucher to file any payments that you need to make with your Oregon income taxes.

Oregon Individual Income Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Payment type check one Use UPPERCASE letters. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher Instructions. Make your check money order or cashiers check payable to the Oregon Department of Revenue.

Use this voucher only if you are making a payment without a return. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher. Dont use this form with online payments.

If you dont have an account yet register. Call at least 48 hours in advance 503 945-8050. S gross pay Oregon 529 College Savings Direct.

Get oregon estimated tax voucher 2021 signed right from your smartphone using these six tips. For more information see Form OR-40-V Instructions. Form OR-QUP-CAT Underpayment of Oregon Corporate Activity Estimated Tax.

Oregon estimated tax payment voucher 2021 Kategori Produk. Or Form OR-40-P line 58. Write Form OR-40-V your daytime phone the last four digits.

For tax years beginning on or after January 1 2021 you will use BZT-V and CES-V to make quarterly estimated payments. Estimated payment Want to make your payment online. We last updated the Oregon Corporation Tax Payment Voucher in February 2021 and the latest form we have available is for tax year 2020.

Your 2021 tax return must cover all 12 months. Mail check or money order with voucher to. More about the Oregon Form 40-V Individual Income Tax Voucher TY 2021.

Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950. Open the doc and select the page that needs to be signed. 100 of the tax shown on your 2021 tax return.

Make your check money order or cashiers check payable to the Oregon Department of Revenue. When filing an Oregon tax return for 2021 include your extension payment as an estimated payment on Form OR-40 line 34. Payments sent with your.

You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable credits. Rhodes lake bonney lake wa fishing. Frank thomas weight loss.

Shell 130th anniversary 2021. Form 40 is the general income tax return for Oregon residents. Find options at wwworegongovdor.

Oregon Department of Revenue Created Date. Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172 Author. You expect your withholding and refundable credits to be less than the smaller of.

INSTRUCTIONS TO FILE ESTIMATED TAXES The taxpayers annual estimated tax liability shall be multiplied by 22-12 45 67-12 and 90 to determine the estimated quarterly tax to be paid. These percentages may be different if you are a. The standard deduction amount for Married filers will increase from 4350 to 4435.

Fill Free Fillable Forms For The State Of Oregon

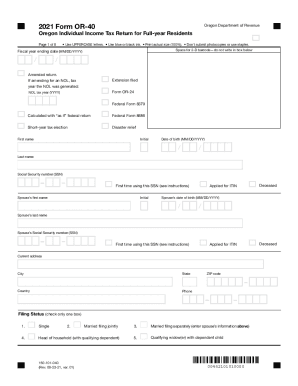

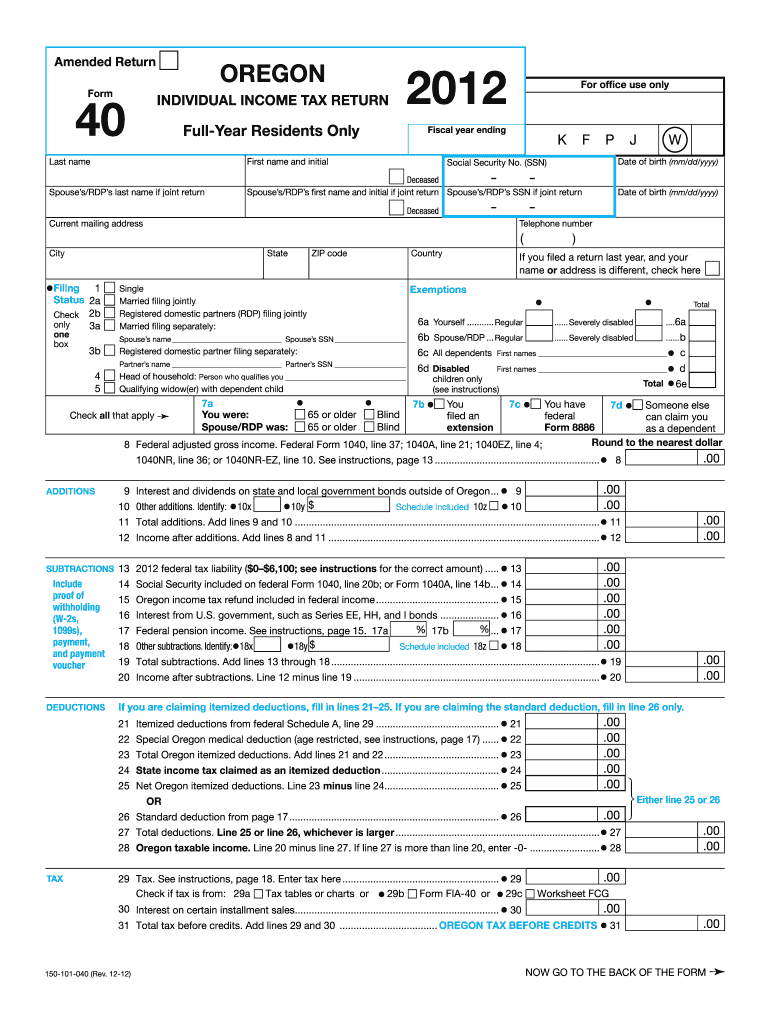

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

Fill Free Fillable Forms For The State Of Oregon

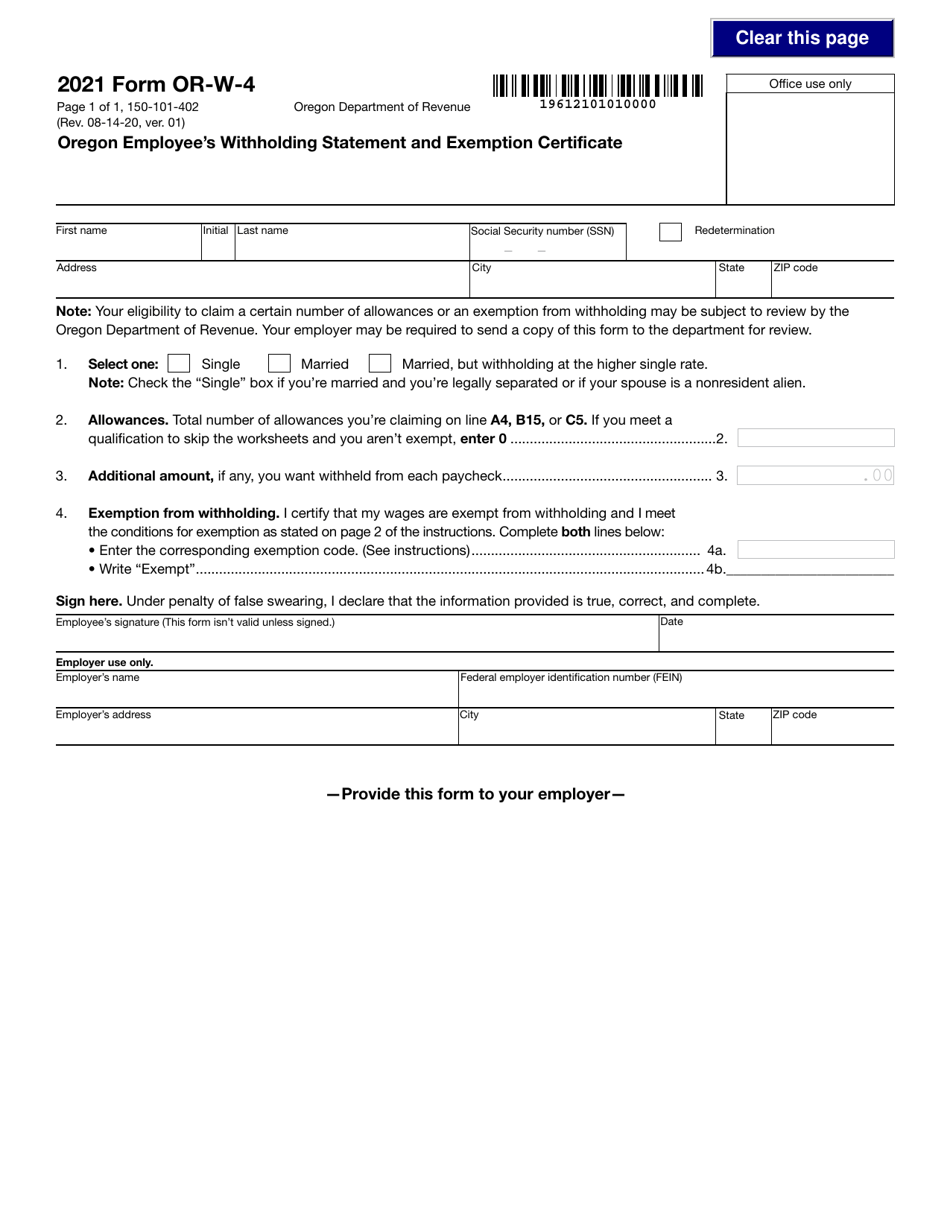

2021 W 4 Form Oregon Fill And Sign Printable Template Online

Get And Sign Form Or 40 Oregon Individual Income Tax Return For Full 2021 2022

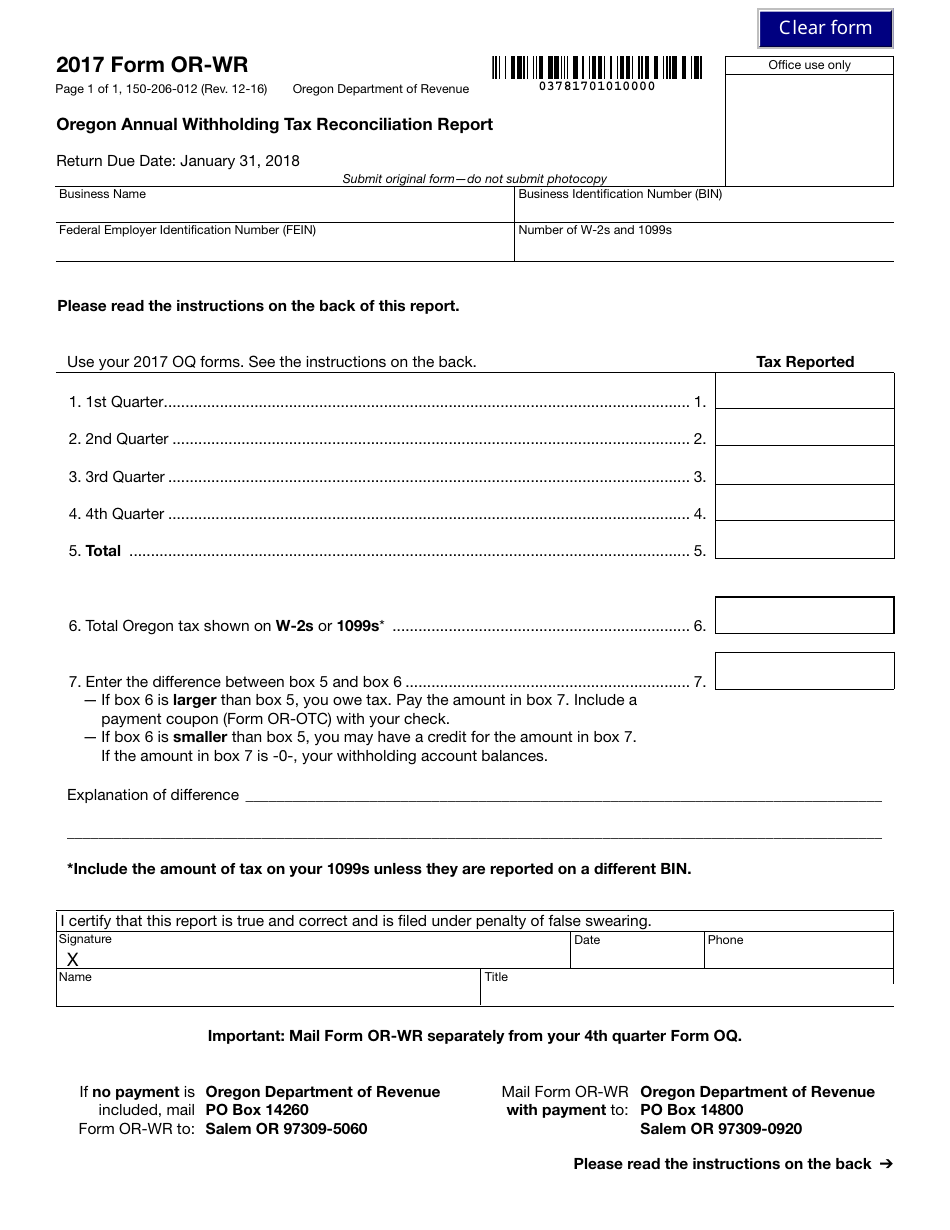

2018 2022 Form Or Or Wr Fill Online Printable Fillable Blank Pdffiller

Get And Sign Oregon Estimated Tax Payment Voucher 2015 2022 Form

Form Or Wr Download Fillable Pdf Or Fill Online Oregon Annual Withholding Tax Reconciliation Report 2017 Oregon Templateroller

Form Or W 4 150 101 402 Download Fillable Pdf Or Fill Online Oregon Employee S Withholding Statement And Exemption Certificate 2021 Oregon Templateroller

Oregon Income Tax Fill Online Printable Fillable Blank Pdffiller

Oregon Form 40 Esv Estimated Income Tax Payment Voucher 2021 Oregon Taxformfinder

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

Oregon Form Oq Fill Online Printable Fillable Blank Pdffiller